Your life will not alter considerably when your financial institution offers your lending. You'll still make the same settlements, simply to a different address. When lenders offer your mortgage to establishments like Fannie Mae, Freddie Mac or the three primary federal government firms, they often retain servicing civil liberties. When either of these 2 entities acquisitions home mortgages, they sell them to exclusive investors as mortgage-backed safety and securities. As you continue to pay on your mortgage, Fannie Mae as well as Freddie Mac use this money to repay the investors who acquired their safeties. As soon as you obtain the notice that your car loan is being marketed, review it very carefully.

- This legislative campaign apart industrial financial from financial investment financial, offering safeguards against feasible corruption with numerous types of investment protections.

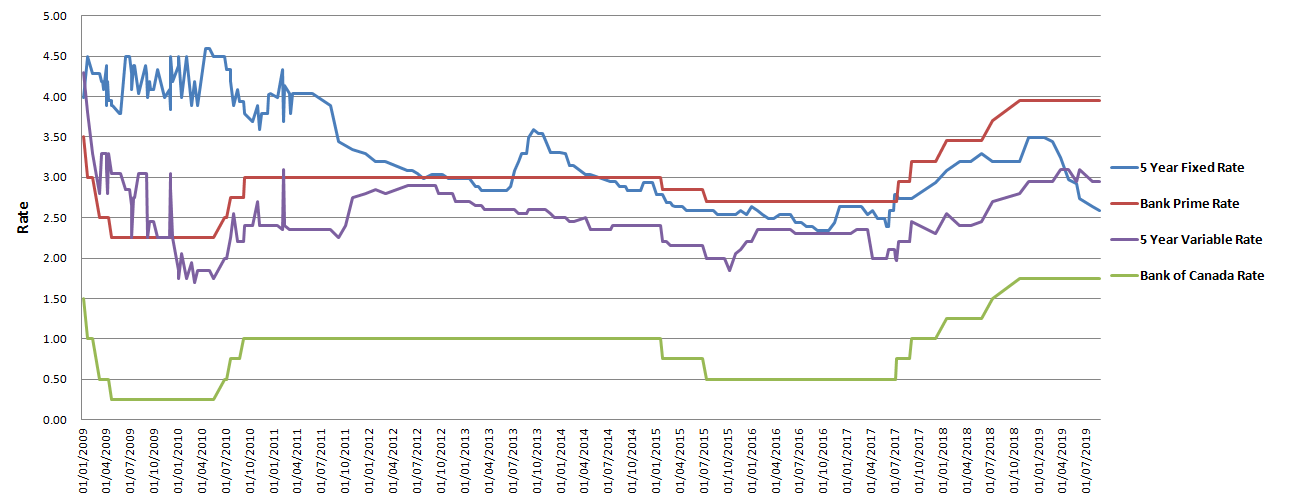

- A variable rate home loan is defined as a type of home loan in which the interest rate is not fixed.

- This makes certain the lender's rate of interest in the residential or commercial property ought to the customer default on their financial commitment.

- Home mortgages are additionally referred to as liens against residential property or claims on residential or commercial property.

- Being pre-approved for a mortgage can offer customers a side in a limited real estate market, due to the fact that You can find out more vendors will certainly understand that they have the money to back up their offer.

The whole funding balance becomes due when the consumer dies, moves away permanently, or sells the home. If the application is authorized, the lending institution will certainly supply the debtor a lending of as much as a certain amount and also at a particular rate of interest. Buyers can obtain a home loan after they have actually selected a building to acquire or while they are still buying one, a procedure referred to as pre-approval. Being pre-approved for a home mortgage can give buyers an edge in a limited real estate market, because vendors will understand that they have the money to support their deal.

Why Does The Additional Home Loan Market Exist?

Hearing that your home mortgage has actually been marketed can be difficult, yet do not worry way too much. Investors looking for various other characteristics, such as those based upon threat or timing of capital, can find various other MBS bonds to meet their particular requirements. Our specialists have been helping you understand your cash for over 4 decades. We constantly aim to supply customers with the expert recommendations and tools needed to be successful throughout life's economic journey.

The Fed has a bit of a balancing act right here, since those goals often run in competition with each other. To attain the highest possible price of work, you might pick to keep rates of interest low, due https://zenwriting.net/rillenrycz/house-equity-conversion-home-loan-one-of-the-most-preferred-kind-of-reverse to the fact that more affordable borrowing can promote businesses to invest. This can bring about more employing as well as more cash invested in products and services, which can have a ripple effect and help still much more services prosper.

What Should I Do If My Financial Institution Marketed how to get rid of your timeshare My Home Loan?

We understand this isn't possible for everybody, so feel free to speak with your servicer. Before we get into the "why" of mortgage financiers, it may be valuable to first discuss a few different terms. Power 2014-- 2021 Key Mortgage Servicer Fulfillment Research studies of consumers' complete satisfaction with their home mortgage servicer company.

Put your requests in to every one of them on the very same morning or afternoon, so you recognize they're working from the same market rates, which can alter every few hrs. You might also go ahead and also submit an application per, to ensure that they need to respond with a detailed good belief quote damaging down all the costs. Many individuals don't realize it, however deposit demands may vary from lending institution to lender.

It might turn out that they're offering the very best terms for somebody with your credit and also economic profile on the sort of home loan you're searching for. Examining home mortgage application data and also a variety of other datasets, we documented the crucial existence of darkness financial institutions over the previous decade. Shadow banks had a major market visibility prior to the real estate collision of a years back, yet then pulled away amid widespread failings. Strikingly, considering that 2009, shadow financial institutions have actually recouped their market share and also now make up the bulk of brand-new home loan loaning. Government banking regulations enable financial institutions to offer home loans or move the servicing rights to other establishments. Refinancing is a procedure that permits you to renegotiate the terms of your home mortgage.

Higher limits would certainly have a low-key result on financial institution security due to the fact that well-capitalized banks would certainly continue to maintain a considerable share of conforming fundings on their annual report. Since adjustments to the GSE- funded market influences tail banks substantially, concentrating only on banks, which run dramatically on the jumbo side, would once again understate truth effect of the policy. Consequently, financing task would migrate from typical financial institutions to trail financial institutions.